W-4 Form. It may sound like a boring piece of paperwork, but it can have a big impact on your finances. A W-4 form tells your employer how much federal income tax to take out of your paycheck. If you fill it out incorrectly, you could end up owing money to the IRS or missing out on a bigger refund. That’s why it’s important to understand the W-4 form changes for 2024 and how they affect you.

eBacon is an easy-to-use software platform to manage your time, HR, and payroll in one place. This gives you access to single-click certified reporting. GET A FREE DEMO OF eBACON TODAY.

Revising Your W-4 Form

Did you know you’re allowed – even encouraged – to revise it each year? At the very least, you should periodically peruse your W-4 to ensure your answers are still current. If you’ve had major life changes during the year, it’s a good idea to compensate for those tax differences.

The beginning of 2024 is a great time to address this since there was a slight change from the 2023 form. General instructions from the IRS are on page 2 of their W-2 form (https://www.irs.gov/pub/irs-pdf/fw4.pdf), but to make it easier to fill out you can break instructions down into manageable steps.

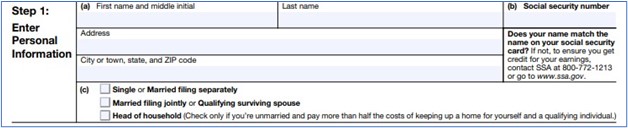

Step 1 – Identification

In the first section, you’re asked to enter personal information including name, address, social security number, and tax filing status.

Step 1 (c), or your tax filing status, may seem confusing but it’s simply your marital status and whether you claim dependents. This is your main section to update if you’ve lost a spouse (divorced or widowed), married, or had children.

Keep in mind that rules could differ based on circumstances. For example:

- If your spouse dies, you can still declare married filing jointly on your tax return and wait to update box (c) in January of the next year.

- New babies can be claimed on taxes during the year of their birth, and you can also update your W-4 immediately – experts recommend within 10 days of birth.

- The opposite is true of a divorce and you must file your tax return with your marital status as of December 31. So, you should update your W-4 immediately to compensate for the tax withholding difference of married versus single filers.

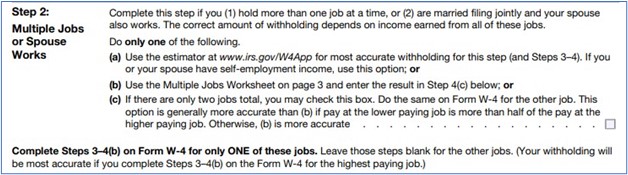

Step 2 – Jobs or Married Filing Jointly

Step two is the section containing the change between the 2023 and 2024 W-4 versions, and it relates to employees who have more than one job at a time or a spouse who also works.

The former W-4 Step 2 (a) read “Reserved for Future Use.” Now Step 2 (a) prompts employees to use the tax withholding estimator tool at www.irs.gov/W4App to see how their withholding affects a refund, take-home pay, or taxes due.

Step 2 (b) refers employees to the Page 3 worksheet supplement to calculate taxes manually or tells you to simply check the box for Step 2 (c) for most cases.

The IRS prompts you to fill out Steps 3-4 (b) for your highest paying job and leave the other jobs’ W-4s blank on this section. Steps 2, 3, and 4 may not apply to all employees, so you’re instructed to skip ahead to Step 5 if they’re not related to you.

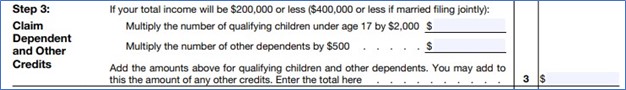

Step 3 – Dependents

Step three is for claiming dependents, including any children. This section is not a requirement and to have more taxes taken out of your paycheck you can choose not to claim them.

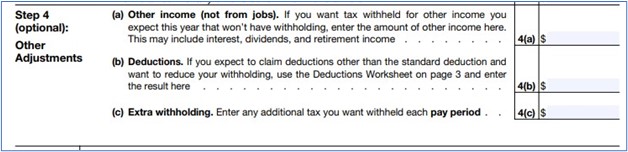

Step 4 – Deductions

In Step Four, you can adjust your information by claiming other deductions or income. You can also set your own additional withholding amount from your pay or ignore these lines completely and send estimated taxes directly to the IRS yourself.

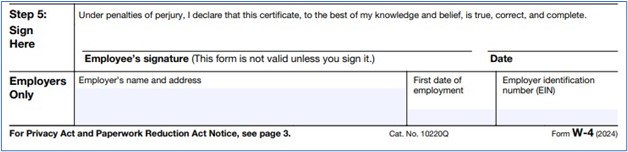

Step 5 – Sign and Date

The final step of your W-4 is to sign and date to acknowledge your information is correct. Your company’s payroll or human resources administrator applies the information to your employee profile and calculates your taxes. Many companies even offer the option for the form to be filled out electronically via their payroll system.

How to File Exempt on W-4 Form

Some employees may wish to have zero taxes withheld from their pay which can be done by writing “EXEMPT” under Step 4 (c). However, employees are only allowed to file exempt from taxes if they owe no federal income taxes the previous year and expect to owe nothing in the current year.

When qualified, employees must submit the exempt W-4 to their payroll administrator by February 15 of the current year. It’s valid only for the calendar year and a new W-4 must be completed annually.

Possible Lock-in-Letter

While employers aren’t required to supply withholding information to the IRS, the IRS does review year-end W-2 Wage and Tax Statements to identify compliance problems. They may issue a notice, often called a lock-in-letter, to employers specifying filing status, multiple job adjustments, and maximum credits and deductions to withhold taxes for an employee.

The IRS allows employees to dispute these determinations before an employer adjusts their taxes, but employers must strictly follow dates from the IRS and ignore previous W-4s the employee submitted.

Other W-4 Form Tax Considerations

If you’re an independent contractor, you shouldn’t fill out a W-4 as the company doesn’t withhold payroll taxes for you. Instead, you must submit a Form W-9 so they can record your correct Taxpayer Identification Number or Social Security Number with the IRS. At year end the company supplies you with a 1099-NEC (not a W-2) that you use to file your federal income tax return.

Your Taxes and Davis-Bacon Prevailing Wage

For companies working on prevailing wage jobs, you may see employee payroll taxes addressed in a couple of places.

On the weekly Form WH-347 to report hours and pay, you are asked to note the Number of Withholding Exemptions employees chose on their W-4. This is merely informational and isn’t used to calculate numbers, but your contracting agency could use the numbers to verify your payroll system is calculating payroll taxes correctly.

Contractors are also required to report tax withholding amounts in the deductions section of the WH-347. Again, this is for contracting agencies to verify that employers are following federal tax laws for their employees and following Davis-Bacon laws.

W-4 Form Completion Recap:

- You will always be required to fill out a W-4 when hired by a new employer unless you’re self-employed when you do a W-9.

- You may revise a W-4 at any time, but you’re not required to do so if your circumstances haven’t changed. Keep in mind, as federal tax brackets evolve, you could end up owing the IRS if you don’t also update your withholdings.

- Any time you change your form W-4, your employer must implement the changes no later than the start of the first payroll period ending on or after the 30th day from the date the form is received.

Get Started with eBacon Today

Personal Protective Equipment Standards: What You Need to Know About OSHA’s Smart New Guidelines

Working in construction can be demanding. Juggling intricate tasks while wearing bulky Personal Protective Equipment (PPE) can feel frustrating and…

Communication is Key: What You Need to Know NOW About HR Strategies and Prevailing Wage

Clear and consistent communication is the bedrock of any successful construction project. But on prevailing wage projects, where strict government…

Construction Workforce Shortages: How to Attract and Retain the Best Workers

Contractors, it’s time to acknowledge a tough reality: construction workforce shortages have been an enduring issue on job sites for…

FTC Non-Compete Clause Rule Changes for Construction Payroll: Everything You Need to Know Now

In the world of construction, where projects are dynamic and workforce needs fluctuate, the recent announcement from the Federal Trade…

Independent Contractors: What You Need to Know to Protect Your Construction Business Right Now

Using independent contractors on your construction projects can seem like a win-win. They bring specialized skills and flexibility, often working…

Staff Up Now! HR Strategies for Clean Energy Construction

Construction worker shortage drama? It’s the same obstacle recognized by many labor industries throughout the country: There’s plenty of work…

The material presented here is educational in nature and is not intended to be, nor should be relied upon, as legal or financial advice. Please consult with an attorney or financial professional for advice.