Every government contractor that works on prevailing wage projects deals with wage determinations. While the idea of a wage determination seems simple, there’s a bit more to it than a list of hourly rates for workers. Understanding wage determinations is critical to staying compliant on government projects. Therefore we want to go over the types of wage determinations you may run into.

Need software to manage your time, HR, & certified payroll? Get a FREE DEMO of eBacon today!

Laws for Prevailing Wage

Prevailing wage laws, both federal and state, set hourly rates for projects funded by the government. At the federal level, the Davis Bacon Act (DBA) applies to projects over $2,000 for the construction, alteration, or repair (including painting and decorating) of public buildings or public works. Davis Bacon and Related Acts (DBRA) is a provision in DBA that applies to “related acts” in which the federal government provides grants, loans, loan guarantees, and insurance for construction projects. The Federal-Aid Highway Act is an example of a “related act.”

Contractors and subcontractors working on projects that fall under these laws have to pay laborers and mechanics no less than the locally prevailing wages and fringe benefits. This is where wage determinations come into the picture because these are published by the DOL and show what these prevailing rates are. It is the Wage and Hour Division (WHD) of the Department of Labor that administers these acts.

Many states have their prevailing wage laws for state-funded public works projects. These are overseen by the state DOL or a similar governing body, like the Department of Industrial Relations (DIR) in California.

What are Wage Determinations

Wage determinations list the hourly pay and fringe benefit rate for every classification of laborer and mechanic. The WHD sets these rates, and they determine them by surveying the area for local wage information. They publish these rates in the form of wage determinations. You can find them on Sam.Gov, the official website for federal wage determinations.

What Types of Determinations Are There?

Although there are wage determinations for every classification of laborer and mechanic, there are only two categories: general wage determinations and project wage determinations.

General determinations

General wage determinations have the current wage rates determined by the WHD for each specific geographic area. Contracting agencies can incorporate these rates into contracts that fall under prevailing wage law. Contractors are required to post them at the worksite on covered projects.

Project determinations

Project wage determinations are requested by a contracting agency and only apply to the project for which they requested them. An agency may request these by submitting an SF-308. Project wage determinations usually expire 180 calendar days after being issued and are not very common.

Types of Construction Represented in Wage Determinations

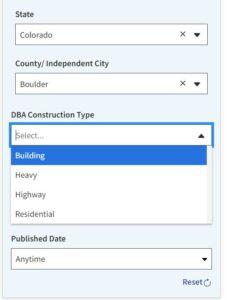

Wage determinations break construction projects into four categories: building, residential, highway, and heavy. When you search for a wage determination you will be asked to select the type of construction to view wage determinations for that category.

Here is what each category includes:

Building

This category includes the construction, alteration, or repair of sheltered enclosures with walk-in access for housing persons, machinery, equipment, or supplies. It includes the installation of utilities and equipment, as well as incidental grading and paving, that may be associated with covered construction.

Residential

This category includes the construction, alteration, or repair of single-family houses, townhouses, and apartment buildings. To be in this category the structure cannot be taller than four stories in height. Associated work for the building is included, like site work, parking areas, utilities, streets, and sidewalks.

Highway

This category includes the construction, alteration, or repair of roads, streets, highways, runways and parking areas. It also covers most other paving work not incidental to building, residential, or heavy construction.

Heavy

This category includes projects that don’t fall into the previous categories. This can make it seem like a catch-all category, but it is distinguished a bit by the characteristics of the construction project, like dredging, water and sewer lines, flood control, and major bridge projects.

Wage Determinations and Conformances

If a project requires work that is not covered by a labor classification already listed on the applicable wage determination, conformance may be needed. This doesn’t create a new classification of labor, but simply determines the prevailing wages for work that’s needed but missing from the wage determination for the project. According to the DOL, this usually only happens if there is a low response rate for the Davis-Bacon wage survey in the area. Conformances are not common, but when they are needed they are granted by the WHD.

Correctly using wage determinations is key to staying out of trouble on your prevailing wage projects. You can learn everything you need to know about them in our wage determination guide.

Personal Protective Equipment Standards: What You Need to Know About OSHA’s Smart New Guidelines

Working in construction can be demanding. Juggling intricate tasks while wearing bulky Personal Protective Equipment (PPE) can feel frustrating and…

Communication is Key: What You Need to Know NOW About HR Strategies and Prevailing Wage

Clear and consistent communication is the bedrock of any successful construction project. But on prevailing wage projects, where strict government…

Construction Workforce Shortages: How to Attract and Retain the Best Workers

Contractors, it’s time to acknowledge a tough reality: construction workforce shortages have been an enduring issue on job sites for…

FTC Non-Compete Clause Rule Changes for Construction Payroll: Everything You Need to Know Now

In the world of construction, where projects are dynamic and workforce needs fluctuate, the recent announcement from the Federal Trade…

Independent Contractors: What You Need to Know to Protect Your Construction Business Right Now

Using independent contractors on your construction projects can seem like a win-win. They bring specialized skills and flexibility, often working…

Staff Up Now! HR Strategies for Clean Energy Construction

Construction worker shortage drama? It’s the same obstacle recognized by many labor industries throughout the country: There’s plenty of work…

The material presented here is educational in nature and is not intended to be, nor should be relied upon, as legal or financial advice. Please consult with an attorney or financial professional for advice.