Welcome to the Institute of eBaconology, your premier online hub for mastering the intricacies of Davis Bacon Act compliance. Dive into our helpful advice covering Davis Bacon, Certified Payroll, Fringe Benefits, Prevailing Wage, Tax Information, and Wage Determinations. Unlock the secrets to seamless adherence with expert tips and guidelines, ensuring your construction firm excels in managing payroll for federal projects.

Three Paycheck Months: A Payroll Tip Guide for Construction Companies

Master the challenges of construction payroll in 3-paycheck months. Smart tips for contractors.

Sustainable Construction Practices: How to Build a Greener Future

Build a greener future with sustainable construction practices. Learn essential tips for workforce management teams to reduce environmental impact.

2025 Salary Threshold Increase for Overtime: Impact on Construction Payroll (and How to Prepare)

Discover how the 2025 salary threshold increase for overtime impacts construction payroll. Learn strategies to manage rising labor costs and ensure compliance.

Year-End Construction Company Payroll Review and How to Checklist

Get the checklist and learn essential construction company payroll review tips for payroll, wage compliance, tax efficiency, and process improvement.

Unlocking Secrets to Accurate Wage Determination in Construction Accounting

Learn how to interpret and apply wage determinations for accurate construction accounting. Avoid common pitfalls and ensure compliance with this guide.

How to Encourage Open Communication About Payroll Issues in Construction

Encourage open communication about payroll issues in construction. Discover strategies to build trust, foster transparency, and protect employee well-being.

Do’s and Don’ts of Switching Payroll Frequencies in Construction

Switching Payroll Frequencies in Construction? Learn how to navigate challenges, ensure Davis Bacon compliance, and streamline your payroll process for a smooth transition.

Prevailing Wage Audits: A Contractor’s Guide with Expert Tips

Learn how to navigate prevailing wage audits with our step-by-step guide. Ensure compliance, maintain accurate records, and communicate effectively with employees.

How to Understand the Effect of Prevailing Wage on Federal Construction Budgets

Explore the effect of prevailing wage on federal construction budgets. Learn how these laws impact costs and discover practical tips for project planning.

Federal School Construction Projects: How To Manage Safety Protocols and Background Checks

Learn how to effectively manage background checks and safety protocols for federal school construction projects. Ensure compliance with our comprehensive guide.

School Construction Projects: How to Manage Prevailing Wage Requirements

Learn how to navigate prevailing wage requirements for federally funded school construction projects. Get tips on compliance, payroll, and workforce management.

Independent Contractors: What You Need to Know to Protect Your Construction Business Right Now

Confusing Independent Contractors with Employees in Construction? Avoid costly misclassification fines! Learn the Final Rule & classification factors.

How to Manage Payroll Changes for Your Construction Office

Learn how to manage upcoming payroll changes such as prevailing wage rules, tax law updates, employee benefits, and overtime regulations.

Common Certified Payroll Mistakes and How to Avoid Them

Avoid costly certified payroll mistakes! Learn how to prevent errors and penalties in your construction projects. Protect your business with our expert guide.

Certified Payroll Audits: What to Expect and How to Prepare

Certified Payroll Audits: Master the process with expert tips. Learn what to expect, how to prepare, and best practices for a smooth audit. Avoid penalties.

Do’s and Don’ts of Switching Payroll Frequencies in Construction

Switching Payroll Frequencies in Construction? Learn how to navigate challenges, ensure Davis Bacon compliance, and streamline your payroll process for a smooth transition.

Certified Payroll versus Regular Payroll: Avoid Costly Mistakes

Confused about certified payroll versus regular payroll? Learn the key differences, compliance tips, and how to manage your construction workforce effectively.

Big News: Government Raises Minimum Wage for Federal Contract Workers

The Department of Labor has updated the minimum wage for federal contract workers under Executive Order 14026, increasing it to $17.75 per hour in 2025.

How to Calculate Fringe Benefits in Certified Payroll

Learn how to calculate fringe benefits for certified payroll accurately with our comprehensive guide. Ensure compliance and improve employee satisfaction.

What You Need to Know About How to Comply with Apprentice to Journeyman Ratios

When delving into the intricacies of apprentice-to-journeyman ratios, understanding the nuances of wage determination is vital before crews embark on federally funded construction projects. Before…

Fringe Benefits 101: What You Need to Know

Confused by prevailing wage fringe benefits? Avoid costly mistakes & save money! This guide explains annualization & explores smarter payment options.

Cash vs. Value: Choosing the Right Approach for Fringe Benefits

Discover why paying fringe benefits in cash costs construction companies thousands annually. Learn alternatives and how to save money effectively.

Fringe Trust Options: Choosing the Best Strategy Right Now

Discover the benefits of a fringe trust for managing fringe benefits efficiently. Learn about compliance with prevailing wage laws and essential strategies.

What You Need to Know About Paying Cash Fringe Benefits

Government contracts can be a great source of income for construction companies, but they are often more complicated than private projects. The rules and regulations…

How to Manage Payroll Changes for Your Construction Office

Learn how to manage upcoming payroll changes such as prevailing wage rules, tax law updates, employee benefits, and overtime regulations.

Prevailing Wage Audits: A Contractor’s Guide with Expert Tips

Learn how to navigate prevailing wage audits with our step-by-step guide. Ensure compliance, maintain accurate records, and communicate effectively with employees.

Prevailing Wage Documentation: Best Practices to Transform Your Record-Keeping

Ensure compliance with prevailing wage laws with accurate prevailing wage documentation. Learn essential documents, best practices, and tips for record-keeping.

How to Understand the Effect of Prevailing Wage on Federal Construction Budgets

Explore the effect of prevailing wage on federal construction budgets. Learn how these laws impact costs and discover practical tips for project planning.

Prevailing Wage Resources You Need to Know: A Guide for Construction Contractors

Discover essential prevailing wage resources and strategies for construction contractors to stay compliant. Learn how these rates connect with payroll and workforce management.

School Construction Projects: How to Manage Prevailing Wage Requirements

Learn how to navigate prevailing wage requirements for federally funded school construction projects. Get tips on compliance, payroll, and workforce management.

Save Big: Tax Incentives for Hiring Veterans in the Construction Industry

Struggling to find skilled construction workers? Learn how Tax Incentives for Hiring Veterans can build your workforce & save you money.

FUTA and SUTA Compliance Made Easy: A Construction Payroll Guide

Unlock the secrets of FUTA and SUTA compliance in construction payroll. Navigate tax complexities with expert insights for business success.

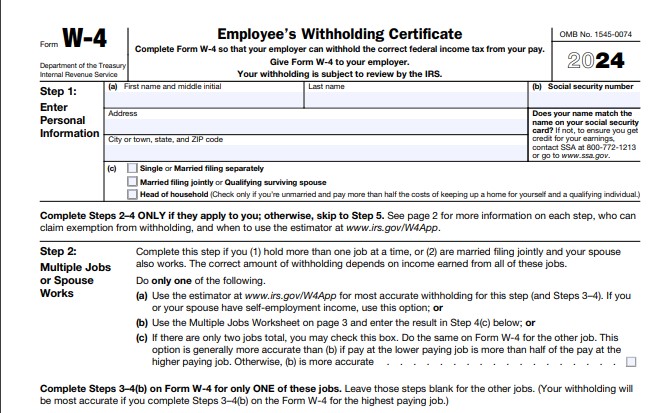

How to Fill Out Your W-4 Form for 2024

W-4 Form. It may sound like a boring piece of paperwork, but it can have a big impact on your finances. A W-4 form tells…

All You Need to Know on How to Simplify W2 Form Delivery and Filing for Your Employees

When January rolls around, it’s inevitable that payroll administrators nationwide begin fielding calls with the same tax question: “When will I get my W-2 Form?”…

What You Need to Know About Processing 1099 Employees for Certified Payroll

You may assume that 1099 employees – often known as independent contractors or self-employed workers – are the answer to all of your payroll problems.…

Employee Retention Tax Credit Changes: What You Need to Know Now

House Committee expresses deep concerns about Employee Retention Tax Credit (ERTC) backlog and misleading IRS statements, urging swift resolution.

Unlocking Secrets to Accurate Wage Determination in Construction Accounting

Learn how to interpret and apply wage determinations for accurate construction accounting. Avoid common pitfalls and ensure compliance with this guide.

Prevailing Wage Resources You Need to Know: A Guide for Construction Contractors

Discover essential prevailing wage resources and strategies for construction contractors to stay compliant. Learn how these rates connect with payroll and workforce management.

Prevailing Wage Worker Classification: The Ultimate Guide for Construction Contractors

The world of prevailing wage worker classification in construction can feel like a high-wire act. One wrong move – misclassifying an employee – can send…

What You Need to Know About How to Comply with Apprentice to Journeyman Ratios

When delving into the intricacies of apprentice-to-journeyman ratios, understanding the nuances of wage determination is vital before crews embark on federally funded construction projects. Before…

Proven Strategies: How to Excel with Government Wage Determinations Now

Unlock the secrets of government contracts! Learn to navigate wage determinations for compliance and success. Essential insights for contractors.

The Hidden Secrets of Wage Determinations (Contractors Must Know!)

Facts about wage determinations that every construction company that does certified payroll needs to know.